Cannabis industry financial performance really took a hit last year, causing many investors to take a step back and reconsider their position. And since COVID-19 appeared as a serious threat, the financial markets have become volatile and chaotic. Some investors have shared with us that they have pulled out of the market entirely and are holding cash positions in order to protect themselves from further losses. This is one way to respond to the current climate; however, we believe that investors do have other options.

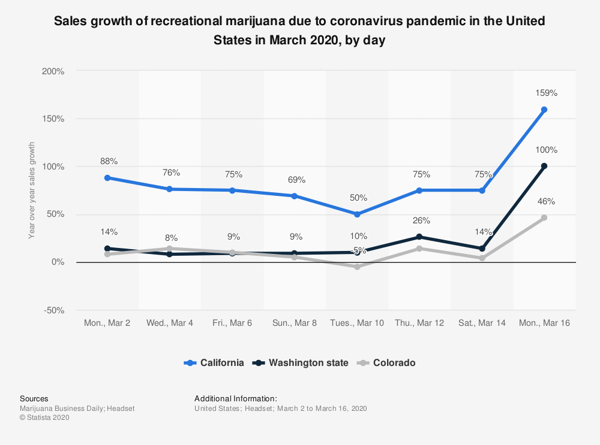

Despite the fact that authorities across the United States have enforced new guidelines and regulations to limit exposure to and transmission of COVID-19, marijuana sales have been up. “We have a huge uptick of people and they're purchasing larger amounts of cannabis," said Wanda James in a recent USA Today article. Industry expert Matt Karnes of cannabis data firm Green Wave Advisors said cannabis users are stocking up for the same reason people are stockpiling supplies: fear that the desired product will run out.

And NPR reports that New York and California have deemed marijuana dispensaries as “essential businesses” that can remain open alongside grocery stores, banks, and gas stations. A spokesperson for New York Governor Andrew Cuomo told NPR that "registered organizations in the State's Medical Marijuana Program are essential medical providers and will (be) allowed to remain open."

Governmental health restrictions and the lack of foot traffic is going to take its toll on companies, and some will have to close their doors for good. However, cannabis companies do have the opportunity to continue to scale and grow if they can think outside the traditional brick and mortar “box.”

For example, in a recent interview by Real Money, dispensary Airfield Supply Co. (San Jose, CA) said that when they announced free delivery via its fleet of Teslas, delivery sales went up a full 100%. "I think we could be seeing the cannabis industry's Amazon Prime moment," said Airfield Supply Co.'s Chris Lane. "The rapid shift to online ordering and delivery is having a powerful impact - and this could set the tone for consumer shifts in how we purchase cannabis moving forward."

Let's not forget, though, that cannabis stocks have been in a bear market for the better part of a year—many down more than 75% off the highs seen in early 2019. This has made access to capital across the sector a major challenge, and now that the economy seems headed into a recession, cash strapped companies will find it even more difficult to raise the capital to grow and scale, let alone operate, according to a recent Forbes article. The problem is compounded because cannabis remains illegal at the federal level, which means that cannabis businesses will not qualify for assistance from the nearly $2 trillion bailout package that is still on the table and yet to be passed by Congress. What was already shaping up to be a difficult year may become even more challenging for cannabis business owners and employees alike.

Those same limitations, however, create incredible demand for Good Tree Capital's debt capital fund—a low-risk, high-return opportunity that the wariest investor must consider.

We would love to have a conversation about how our fund can meet your investment goals amidst unprecedented uncertainty in the equity markets. Please reach out to schedule a chat with our team or download our prospectus.